Car insurance is a necessity, but that doesn't mean you should overpay. One of the most common questions we hear at OCHO is: "How much should I be paying for car insurance?" It's a smart question because rates vary dramatically based on numerous factors.

The average American pays around $1,770 annually for full coverage car insurance (about $148 per month), but your specific situation could result in a much different number. Let's break down what goes into car insurance pricing and what you should expect to pay. 📊

There's no one-size-fits-all answer to how much car insurance should cost. Your premium depends on:

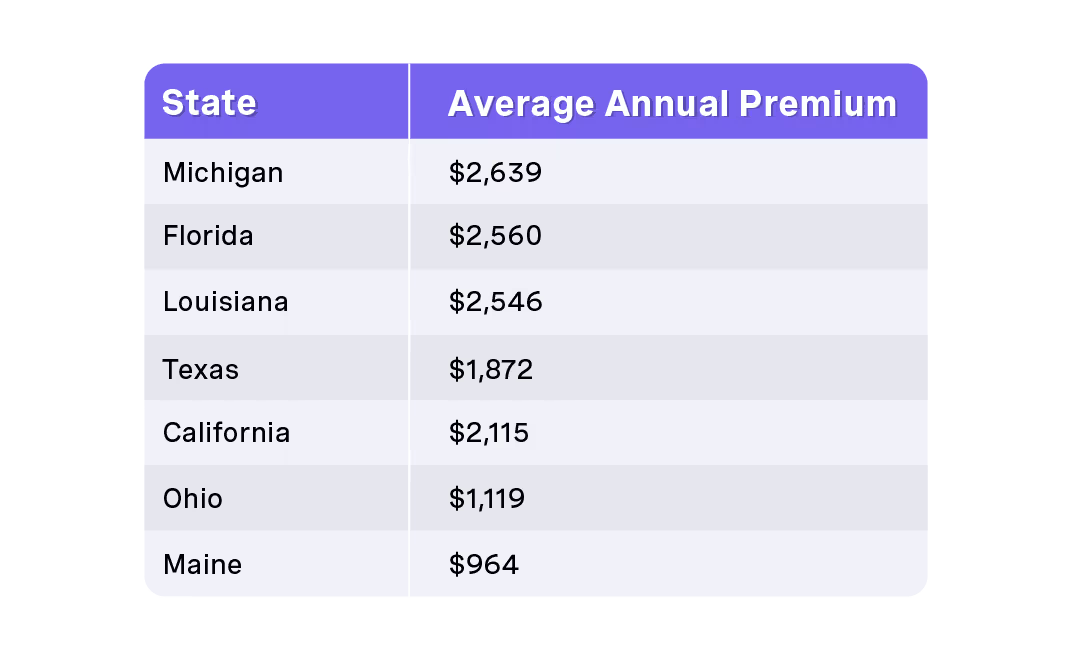

Where you live significantly impacts your insurance costs. Here's a snapshot of average annual full coverage premiums in different states:

These differences exist because of varying:

If you're a Texas resident, check out our guide to Texas car insurance for state-specific insights.

Understanding what influences your premium can help you determine if you're paying a fair price:

The more coverage you have, the more you'll pay. Basic liability coverage costs significantly less than full coverage with comprehensive and collision.

For example:

Additional coverages like rental reimbursement (learn about rental car coverage during repairs) or roadside assistance will increase your premium further.

Your driving history is one of the most influential factors in determining your rate:

Maintaining a clean driving record is one of the most effective ways to keep your insurance costs down.

The make, model, year, and even color of your car affect your premium:

Before buying a new car, consider checking its insurance costs using our car insurance calculator.

Age significantly impacts insurance rates, particularly for young drivers:

Young drivers pay more because statistics show they're more likely to be involved in accidents. However, good student discounts and safe driver programs can help offset these higher rates.

In most states, insurers use credit-based insurance scores to help determine premiums. Drivers with poor credit may pay 40-50% more than those with excellent credit.

This practice has been controversial, and some states (like California, Hawaii, and Massachusetts) have banned it. If you're working to improve your credit, OCHO's on-time payment reporting can help build your credit score over time.

Even within the same state, premiums can vary significantly:

For example, car insurance in Houston might cost 15-20% more than in rural areas of Texas.

While the "right" price varies widely, here are some benchmarks based on coverage level and driver profile:

These are general ranges—your actual rates could be higher or lower depending on your specific circumstances.

How do you know if you're overpaying? Watch for these red flags:

If any of these apply to you, it's time to shop around using our car insurance comparison tool.

Most insurers offer various discounts that can significantly reduce your premium:

Ask about all available discounts when shopping for insurance—they can add up to significant savings.

Finding the right balance between coverage and cost is key:

Don't settle for the first quote you receive. Different insurers weigh rating factors differently, resulting in varied prices for the same coverage.

Higher deductibles lower your premium but mean more out-of-pocket costs if you file a claim. Find the balance that works for your budget.

As your car ages, you might be able to drop comprehensive or collision coverage if your car's value has significantly decreased.

If you don't drive much, usage-based insurance might save you money.

Traditional insurers often require large upfront payments. OCHO offers no deposit car insurance options that make getting covered more affordable.

At OCHO, we understand that standard insurance pricing and payment models don't work for everyone. That's why we offer:

Align insurance payments with your pay schedule, making budgeting easier.

Get insured without the burden of a large upfront payment.

We provide extra time to make payments when you need it, without imposing penalties.

On-time payments are reported to credit bureaus, helping improve your credit score over time.

While it's important not to overpay for car insurance, being underinsured can be even more costly. Consider this example:

Scenario: You choose minimum liability coverage ($30,000) to save money, then cause an accident resulting in $50,000 of damage to another vehicle.

Result: Insurance covers $30,000, but you're personally responsible for the remaining $20,000—plus your own vehicle repairs.

The extra $10-20 per month for higher coverage limits could save you from financial disaster in this scenario.

Similarly, skipping comprehensive coverage might save you $20-40 monthly but leave you with no coverage if your car is damaged by hail or other non-collision events.

Instead of focusing solely on finding the lowest price, consider the value you're getting:

The right insurance balances affordable premiums with adequate protection.

How much should car insurance cost? The answer depends on your unique situation, but one thing is clear: you shouldn't pay more than necessary for the coverage you need.

At OCHO, we believe everyone deserves access to affordable insurance with payment terms that match their financial reality. Our flexible options make quality coverage accessible regardless of your budget or payment schedule.

Ready to see if you could be paying less for car insurance? Get a free quote today and discover how OCHO's innovative payment solutions can help you get the coverage you need at a price you can afford.

Compare & get covered fast

Find and compare auto insurance in minutes, and get your free credit score.

Choose when you pay

Select payment dates that line up with your payday.

Manage everything in one place

Track your policy, manage payments, and request a payment extension right from your dashboard.