Car insurance canceled due to missed payments? Don't panic. While a lapsed car insurance policy can feel overwhelming, understanding how to reinstate car insurance can help you get back on the road legally and affordably. Whether you're dealing with a recent cancellation or wondering about your options, this guide covers everything you need to know about car insurance reinstatement. Before you renew your policy, explore how OCHO helps drivers find truly cheap car insurance through flexible payment plans and zero-down options.

Reinstating car insurance means restoring your coverage after it's been canceled or lapsed. Unlike starting a completely new policy, reinstatement allows you to continue with your existing insurer under the same policy terms—if you act quickly enough.

The key difference: Reinstatement can potentially avoid a gap in your insurance history, which helps prevent higher premiums down the road.

Understanding why your policy was canceled helps determine your reinstatement options:

Time is critical when your car insurance lapses. Most insurers offer a grace period (typically 10-30 days) during which reinstatement is easier and less expensive.

What to ask:

Car insurance reinstatement typically involves several fees:

Example breakdown:

Missed premium payment: $150

Late fee: $25

Reinstatement fee: $35

Total to reinstate: $210

Your insurer will specify whether reinstatement includes:

No-lapse reinstatement: Coverage is backdated to your original cancellation date, maintaining continuous coverage.

Lapse reinstatement: Coverage begins from the date you complete reinstatement, creating a gap in your insurance history.

Depending on your situation, you may need to:

Once reinstated, verify:

Most insurance companies offer grace periods after a missed payment before officially canceling your policy. Understanding your grace period can help you avoid cancellation altogether.

Typical grace periods:

During the grace period:

Sometimes reinstatement isn't an option:

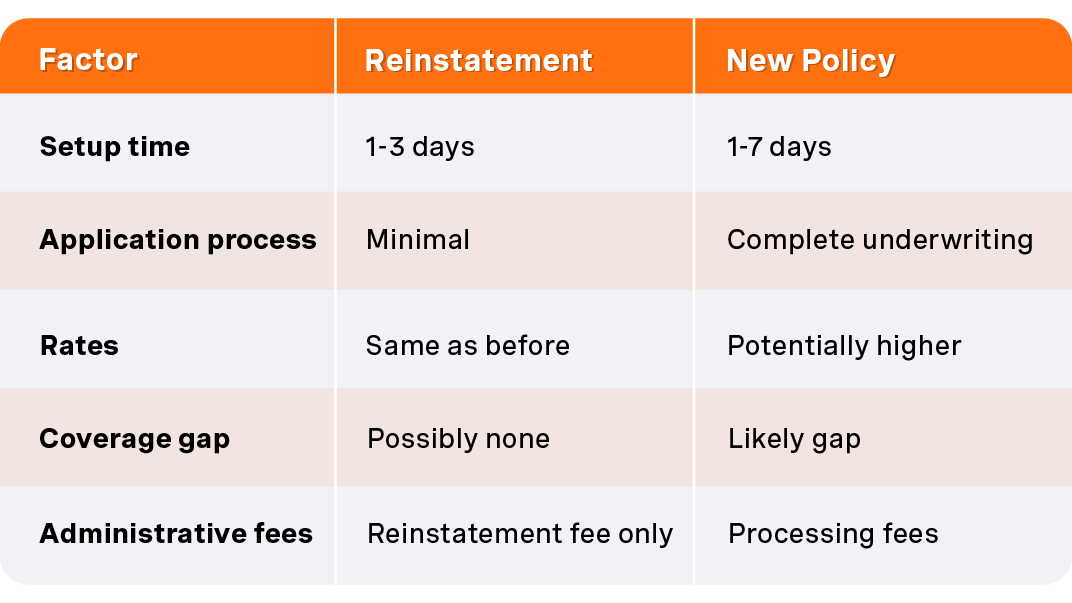

When reinstatement makes sense:

When a new policy might be better:

Traditional car insurance reinstatement can be confusing because most insurers require payment upfront before you use coverage. OCHO works differently—you drive now and pay over time.

When you signed up with OCHO, we loaned you money to pay your insurance company directly. This means:

Why This Matters: Many customers think they've "already paid" when they see a reinstatement bill higher than their usual payment. You're not being charged twice—you're settling the loan for insurance coverage you already received but haven't fully paid for yet.

Your OCHO reinstatement amount typically includes:

Detailed OCHO reinstatement breakdown:

Total 6-month policy cost: $1,200

Down payment made: -$100

Remaining balance: $1,100 (split into 11 payments of $100)

Daily rate: ~$6.59 ($1,200 ÷ 182 days)

Days of insurance used: 24 days (14 days active + 10-day grace period)

Cost of used insurance: $158.16 (24 × $6.59)

Reinstatement + other fees: $25.00

Total amount due: $183.16

Policy Changes Affect Pricing: When you make changes to your policy, the insurance company reassesses your premiums. OCHO doesn't control pricing—the insurer makes these decisions based on new information.

Common scenarios that increase costs:

Multi-Driver/Vehicle Discounts: Removing a driver or vehicle means losing discounts, which increases your premium.

Vehicle Changes: Each car has different insurance rates. More expensive, modified, or high-theft vehicles cost more to insure. We recently had a customer replace their car with a Tesla near the end of their policy term—with only 19 days left, the $380 premium increase couldn't be spread across multiple payments, requiring a $439.50 final payment.

Address Changes: Moving can significantly impact rates. We've seen customers' premiums increase by hundreds of dollars just by moving a few blocks to a different ZIP code.

End-of-Term Changes: If you make changes near your policy's end, there isn't enough time to spread premium increases across multiple installments, resulting in a larger final payment.

Processing Time: 2-5 business days (this is the insurance company's timeline, not OCHO's)

Who Decides: Only the insurance provider decides whether to approve reinstatement—OCHO facilitates but doesn't make this decision.

Coverage Effective Date: Once approved, your policy is backdated to the date you completed all reinstatement steps:

Example: If you request reinstatement on June 1st but the insurer doesn't approve until June 4th, your coverage is effective starting June 1st—you're covered during the waiting period.

In most cases, OCHO creates a new payment schedule after reinstatement. We do our best to keep it aligned with your original plan (usually based on your paycheck dates), but if reinstatement happens very close to your next scheduled payment, we adjust to avoid charging you twice back-to-back.

Example: If you reinstate today and a payment was due tomorrow, we'll remove tomorrow's payment and spread that amount across your remaining installments. Your future payments might be slightly higher, but the total amount stays the same.

Some carriers offer no-lapse reinstatement, which lets you pay to cover the days you missed since cancellation. This helps avoid gaps in your insurance history, which can lead to lower prices in the future.

Because you're paying for more days of coverage, this option costs more upfront. Not all providers offer it—contact us to check if it's available for your policy.

Most insurance providers give you 10-60 days to reinstate, with 30 days being most common. If OCHO shows you the reinstatement option, you're still eligible—but not for long. Act quickly to avoid having to reapply, which may result in higher rates.

Don't worry—we've got options:

Leased Vehicles: If your lienholder needs confirmation that you're reinstating, have them contact OCHO directly. We'll verify your status and explain the situation on your behalf.

Multiple Cancellations: If this isn't your first cancellation, reinstatement may not be available, but we'll help you find alternative coverage options.

No. Once your policy is canceled, you have no coverage. Driving during this time is illegal and financially risky.

Most insurers allow 30-60 days for reinstatement, though some offer as little as 10 days. OCHO will show you the reinstatement option only while you're still eligible.

If you reinstate within the grace period with no coverage gap, your rates typically stay the same. However, if there's a lapse in coverage, you may face higher premiums at renewal.

A no-loss statement is a document confirming you had no accidents, claims, or losses during your coverage lapse. This allows insurers to backdate your coverage without gap.

No, reinstatement only works with your original insurer. If they won't reinstate, you'll need to apply for a new policy, either with them or another company.

Usually, yes. Reinstatement typically involves only the missed payments and fees, while new policies may have higher rates due to the coverage lapse.

You're not being charged twice. OCHO's model means you drive first, then pay. Your reinstatement covers insurance days you already used but haven't paid for yet, plus any policy changes that affected your premium.

Policy changes (adding/removing drivers or vehicles, address changes, vehicle swaps) can affect your premium. If changes happen near your policy's end, premium increases can't be spread across multiple payments, resulting in higher reinstatement costs.

Typically 2-5 business days. This timeline comes from the insurance company, not OCHO. We facilitate the process, but the insurer makes the final approval decision.

Yes, if approved, your coverage is backdated to when you completed all reinstatement requirements (payment, documentation, signatures), not the approval date. You're covered during the processing period.

We create new schedules to align with your paycheck and avoid double-charging. If reinstatement happens close to your next scheduled payment, we'll adjust the schedule and spread amounts across remaining installments.

Have your lienholder contact OCHO directly. We'll verify your reinstatement status and explain the situation on your behalf.

Some carriers offer no-lapse reinstatement, which covers missed days to avoid gaps in your insurance history. This costs more upfront but can lead to better future rates. Contact us to see if this option is available for your policy.

Car insurance cancellation doesn't have to derail your finances or transportation. Whether you're looking to reinstate your current policy or need a fresh start, OCHO's flexible payment options make getting covered easier.

Ready to reinstate or get a new policy?

Don't let a lapsed car insurance policy keep you off the road. Contact OCHO today to explore your options and get the coverage you need at a price you can afford.

Finally, car insurance you can afford. Start your OCHO journey today.

Compare & get covered fast

Find and compare auto insurance in minutes, and get your free credit score.

Choose when you pay

Select payment dates that line up with your payday.

Manage everything in one place

Track your policy, manage payments, and request a payment extension right from your dashboard.