In today’s evolving auto insurance landscape, terms like “pay-as-you-go“ and “pay-per-mile” are increasingly common, with several companies now offering these flexible insurance options. While both options sound similar and promise greater flexibility than traditional insurance, they actually represent distinctly different approaches to coverage. Understanding these differences is crucial for finding the insurance structure that best fits your driving habits and financial situation, giving you more control over your insurance costs. If you’re trying to lower your monthly costs, check out our guide to finding cheap car insurance without sacrificing coverage.

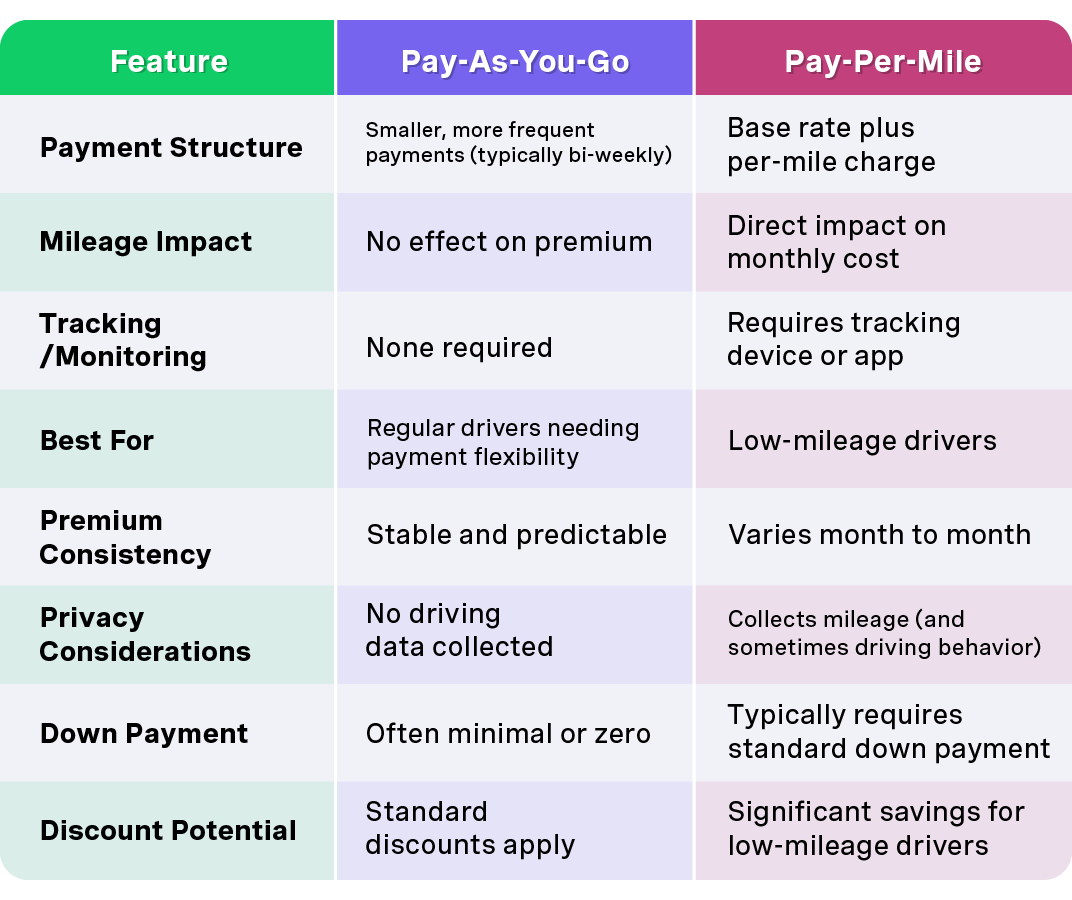

Before diving into details, here’s the fundamental difference:

Now let’s explore each option in depth.

Pay-as-you-go car insurance is a payment model that breaks down your premium into smaller, more manageable installments. These plans often come with flexible payment plans, allowing you to choose options that fit your budget and pay schedule. Instead of paying large lump sums quarterly or semi-annually, you make smaller payments more frequently—typically bi-weekly or monthly. Some providers also let you get insurance instantly, so you can get covered without delays.

Pay-as-you-go insurance is ideal for:

With OCHO's pay-as-you-go insurance, you might pay $50 every two weeks instead of $200-$300 monthly. The coverage remains identical to traditional insurance, but the payment structure aligns better with how most people manage their finances—particularly those paid bi-weekly.

Pay-per-mile (also called usage-based insurance) directly links your premium to the distance you drive. Your bill typically consists of a base rate plus a per-mile charge, measured through a plug-in device or smartphone app. Some providers use a telematics device or black box to track your miles driven, allowing for accurate measurement without requiring additional manual input. Pay per mile coverage charges you based on the actual miles driven, making it ideal for those who drive less.

Pay-per-mile insurance works best for:

With a typical pay-per-mile plan, a driver might pay a $30 monthly base rate plus $0.06 per mile. Driving 500 miles in a month would result in a $60 bill ($30 base + $30 for mileage). The same coverage might cost $100-$150 under traditional or pay-as-you-go plans.

Let's break down the specific differences between these insurance models across several key factors:

When it comes to car insurance, both pay-as-you-go and pay-per-mile insurance give drivers the flexibility to choose the coverage that fits their lifestyle and budget. Whether you’re a low mileage driver looking to save money or someone who needs full coverage for peace of mind, these modern insurance models offer a variety of options to keep you protected on the road.

Let’s break down the specific differences between these insurance models across several key factors:

Factors like driving behavior and mileage matter when determining your premium with pay-as-you-go car insurance. Insurers use telematics or tracking technology to assess how safely and how much you drive, which directly impacts your rate.

When comparing costs, you typically pay less if you drive fewer miles under pay-per-mile or pay-as-you-go models. This means your payments are closely tied to your actual usage, so low-mileage drivers can save more.

Eligibility and coverage for these insurance models can apply to almost any type of vehicle, including cars, trucks, and SUVs. Many programs use systems that monitor vehicle mileage or driving behavior to determine premiums.

Many drivers confuse pay-as-you-go with pay-per-mile because both offer alternatives to traditional payment structures. However, as we've seen, they address completely different needs.

Some drivers mistakenly believe pay-as-you-go insurance provides temporary or intermittent coverage. In reality, it offers continuous coverage just like traditional insurance—only the payment schedule changes.

While pay-per-mile can save money for low-mileage drivers, it's often more expensive for those who drive regularly. Someone driving 15,000+ miles annually would likely pay more with pay-per-mile than with traditional or pay-as-you-go insurance.

The payment structure doesn't affect coverage limits or types. You can get the same comprehensive protection with pay-as-you-go as with traditional insurance.

The best option depends entirely on your personal circumstances: consider your budget, driving habits, and how much flexibility you need. Pay as you go car insurance can be a smart choice for those seeking affordable, flexible coverage. Remember, maintaining continuous coverage with the right insurance model not only protects you now but also helps secure your financial future by reducing risks of higher premiums and credit issues down the line.

At OCHO, we’ve pioneered a pay-as-you-go model designed specifically for drivers who need payment flexibility without sacrificing coverage quality. Our approach offers:

Unlike traditional insurers that require large upfront payments or pay-per-mile providers that penalize regular drivers, OCHO’s pay-as-you-go model ensures affordable, accessible coverage for everyone—especially those living paycheck to paycheck.

Pay-as-you-go insurance availability varies by state due to different insurance regulations. OCHO currently offers pay-as-you-go options in Arizona, Georgia, Illinois, Missouri, New Mexico, Texas, Washington, and Wisconsin, with plans to expand to additional states soon. Check your state's availability for the most current information.

With pay-per-mile insurance, your premium increases directly with your mileage. Most providers cap the daily charge (typically at 250 miles per day) to prevent excessive charges for occasional long trips. However, consistently driving more than anticipated will result in higher bills, potentially exceeding what you'd pay with traditional or pay-as-you-go insurance.

Yes, you can typically switch between insurance models when your policy renews, though mid-term changes may be more difficult. Consider your anticipated driving patterns for the upcoming term before deciding which model makes more sense financially.

No. Both payment models offer the same coverage types and limits as traditional insurance. You can still select liability, comprehensive, collision, and other standard coverages with either option. Both models include liability coverage, which protects you in the event of an accident. Liability coverage can help pay for medical bills and property damage if you are responsible for an accident. The difference lies solely in how you pay, not what’s covered.

Some pay-as-you-go providers, including OCHO, report on-time payments to credit bureaus, which can help build your credit history. This added benefit makes pay-as-you-go insurance particularly valuable for drivers working to establish or improve their credit scores.

Both pay-as-you-go and pay-per-mile insurance offer valuable alternatives to traditional payment models, but they serve distinctly different needs. Understanding these differences helps you choose the option that aligns with your driving habits, financial situation, and personal preferences.

For most regular drivers, especially those seeking payment flexibility without usage tracking, pay-as-you-go insurance provides the ideal balance of convenience and consistency. For infrequent drivers looking to minimize costs based on limited usage, pay-per-mile offers potential savings.

At OCHO, we believe insurance should work with your life, not against it. Our pay-as-you-go model represents the smarter way to stay covered without the financial stress of large premium payments or the limitations of mileage-based pricing.

Ready to explore how pay-as-you-go insurance can make coverage more manageable? Get a free quote today and experience the OCHO difference.

Compare & get covered fast

Find and compare auto insurance in minutes, and get your free credit score.

Choose when you pay

Select payment dates that line up with your payday.

Manage everything in one place

Track your policy, manage payments, and request a payment extension right from your dashboard.